- English

- Español

- Português

- русский

- Français

- 日本語

- Deutsch

- tiếng Việt

- Italiano

- Nederlands

- ภาษาไทย

- Polski

- 한국어

- Svenska

- magyar

- Malay

- বাংলা ভাষার

- Dansk

- Suomi

- हिन्दी

- Pilipino

- Türkçe

- Gaeilge

- العربية

- Indonesia

- Norsk

- تمل

- český

- ελληνικά

- український

- Javanese

- فارسی

- தமிழ்

- తెలుగు

- नेपाली

- Burmese

- български

- ລາວ

- Latine

- Қазақша

- Euskal

- Azərbaycan

- Slovenský jazyk

- Македонски

- Lietuvos

- Eesti Keel

- Română

- Slovenski

- मराठी

- Srpski језик

Add 56GW! European photovoltaics will set a record

2023-12-15

Recently, SolarPower Europe, a trading agency representing the European solar energy industry, released a report predicting the solar power situation on the European continent for the next four years.

The report states that European solar developers are expected to install a record breaking 56GW of new photovoltaic capacity by 2023.

The report titled "2023-2027 European Solar Market Outlook" predicts that the installed solar capacity in Europe will increase by 40% from 2022 to 2023, marking the third consecutive year of at least 40% year-on-year growth in installed solar capacity in Europe.

The institution predicts that the new installed capacity in 2024 will slow down, with an expected growth of only 11% to reach 62GW. But in 2023, nine out of the top ten solar energy markets in Europe will see growth in installed capacity.

"Solar energy continues to bring record breaking installed capacity to Europe in crisis. Now, solar energy is reaching its turning point, and Europe must contribute to solar energy," said Walburg Hemesberger, CEO of SolarPower Europe

"We have not yet reached the average annual installed capacity of 70GW required to achieve the 2030 solar energy target. It is clear that decision-makers cannot be complacent for the remaining ten years."

In 2022, Spain will surpass Germany to become the country with the largest solar installed capacity in Europe, with an additional installed capacity of 8.4GW, while Germany only has 7.4GW.

However, the report predicts that Germany will return to the top spot by the end of this year, with Germany's new installed capacity expected to almost double to 14.1GW and Spain's new installed capacity reduced to 8.2GW.

Among the top ten solar energy markets predicted in the report for 2023, Spain is the only country with a lower installed capacity in 2023 compared to the previous year. The report points out that although the Spanish solar industry achieved "an important milestone" in 2022, the slowdown in rooftop photovoltaic power generation may hinder the long-term development of this industry.

According to SolarPower Europe's data, Spain's rooftop installed capacity needs to reach 1.9GW per year for the next seven years in order to achieve the target of 19GW of domestic solar capacity set by Spain's National Energy and Climate Plan (NECP), which has only been achieved once in the past decade.

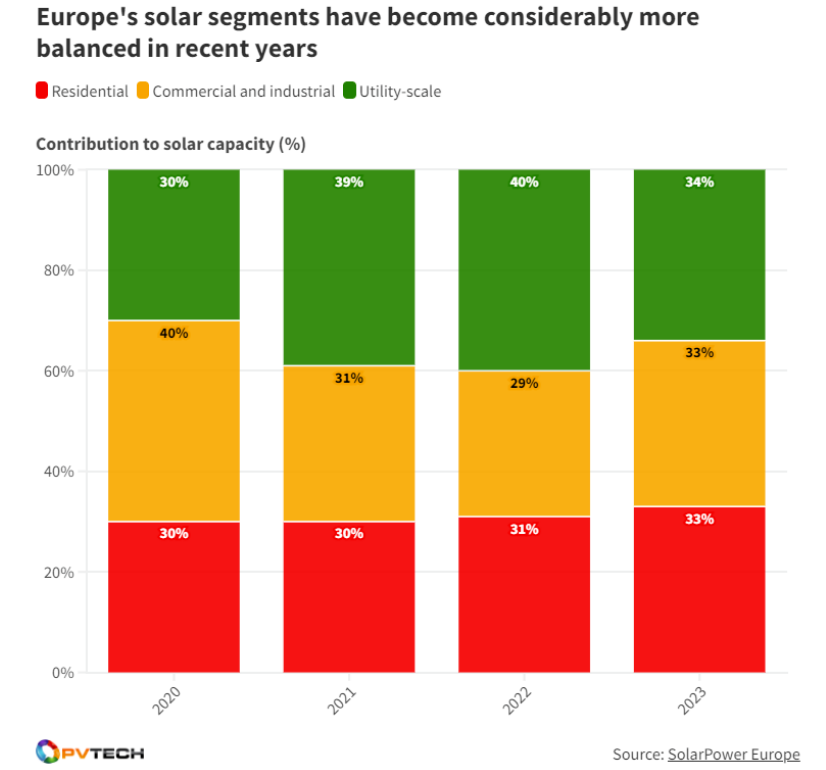

As shown in the above figure, the report also shows the changes that have occurred in the European solar energy industry portfolio over the past six years, with large ground mounted photovoltaics and household solar energy now contributing much more to this industry. In 2020, 40% of solar power generation on the European continent came from commercial and industrial projects, while household and large-scale ground photovoltaic projects accounted for only 30% of electricity generation.

SolarPower Europe predicts that by 2023, this industry will be almost entirely composed of these two parts, with large ground projects accounting for 34% of the industry's installed capacity and commercial and household solar projects accounting for 33%.

Local photovoltaic manufacturing goals

However, the production of European manufacturing is not satisfactory, and the report authors point out that SolarPower Europe's initial goal of achieving an annual production capacity of 30GW of polysilicon, silicon ingots, silicon wafers, batteries, and modules in Europe by 2025 "seems no longer feasible".

The report suggests that 2030 will be a more realistic time frame as Europe's polysilicon manufacturing industry has the ability to produce 26.1 GW of materials annually, but efficiency issues still exist in the silicon ingot, wafer, and battery manufacturing industries, which produce a total of 4.3GW of components annually.

However, the health status of the inverter manufacturing industry in Europe is good, with an annual production capacity of 82.1GW of inverters, which is in line with the manufacturing target of REPowerEU, which is part of the EU's plan to achieve a solar installed capacity of 750GW by the end of this decade.

The report author suggests that European governments can adopt programs similar to the US Inflation Reduction Act and India's Capacity Linked Incentive Plan, both of which encourage private and public institutions to increase investment in solar energy manufacturing.

These conclusions are consistent with what SolarPower Europe called the "precarious situation" in September, as solar developers were able to purchase cheaper materials and components from the United States and China, which dampened the enthusiasm of European manufacturing globally.

National Energy Conservation Plan and Seven Year Plan

The report also explores the future of the European solar industry and makes predictions for the industry's development over the next seven years. Many solar energy programs in Europe are managed by the National Energy Policy Plans (NEPCs) of various governments. This plan was launched in some European countries in 2019 and updated this year to manage the solar energy targets of each country until 2030.

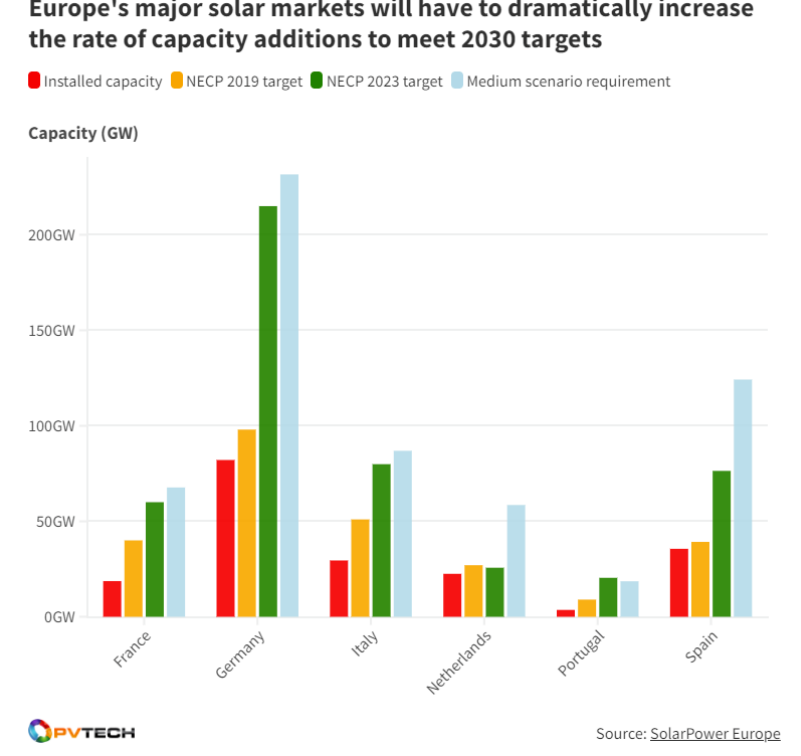

If all update targets for 2023 can be achieved, then by the end of this decade, Europe's solar power capacity will be 90 GW higher than initially expected. However, as shown in the figure below, some of the largest solar markets on the European continent are far behind the total installed capacity targets set in 2019 and 2023, with the Netherlands being closest to achieving these two sets of targets.

All of these countries are also far below SolarPower Europe's "moderate" scenario expectations for the global solar industry. This plan includes the addition of 341GW of global solar installed capacity in 2023 and the expansion of global solar installed capacity to 3.5TW in 2027. The situation in Spain and the Netherlands is particularly concerning, as their governments aim to be close to or less than half of the total installed capacity required by the European Solar Medium Program.

The situation in Portugal deserves optimism. Among the European continent analyzed by SolarPower Europe, it is the only country to exceed the expectations of industry agencies in updating NECP domestically. Although achieving this goal will be a challenge, the ambition of many European countries is growing, and many of them have significantly raised their solar power targets in the latest NECP update, which brings hope for the European solar industry to achieve its goals.

Policy recommendations

To help the European solar industry better achieve its goals, SolarPower Europe has also put forward a series of policy recommendations for the remainder of this decade, including maintaining what SolarPower Europe calls a "favorable investment environment for solar photovoltaic power generation", improving the power grid and flexible infrastructure.

SolarPower Europe is committed to a range of infrastructure and logistics development, including launching an action plan to accelerate grid connection, in order to improve all aspects of the European solar industry.

SolarPower Europe also calls for improved planning and licensing processes to diversify the solar supply chain on the European continent, thereby developing Europe's own manufacturing industry and reducing dependence on imports from markets such as China.

SolarPower Europe also pointed out that in order to support the development of all links in the solar supply chain on the European continent, the European solar industry will need to hire 1 million people by 2025, compared to approximately 648000 people in 2022. SolarPower Europe stated that governments around the world "must restore technical education and employment" and "increase efforts to promote worker mobility" as part of a broad initiative to improve global employee training and deployment in the solar industry.